GA^3 Mileage Reimbursement

- MIT reimburses mileage at the standard IRS Business Mileage Rate

- 2025 rate:

70 cents/mile- email ga3-treasurer@mit.edu if this is out of date

- 2025 rate:

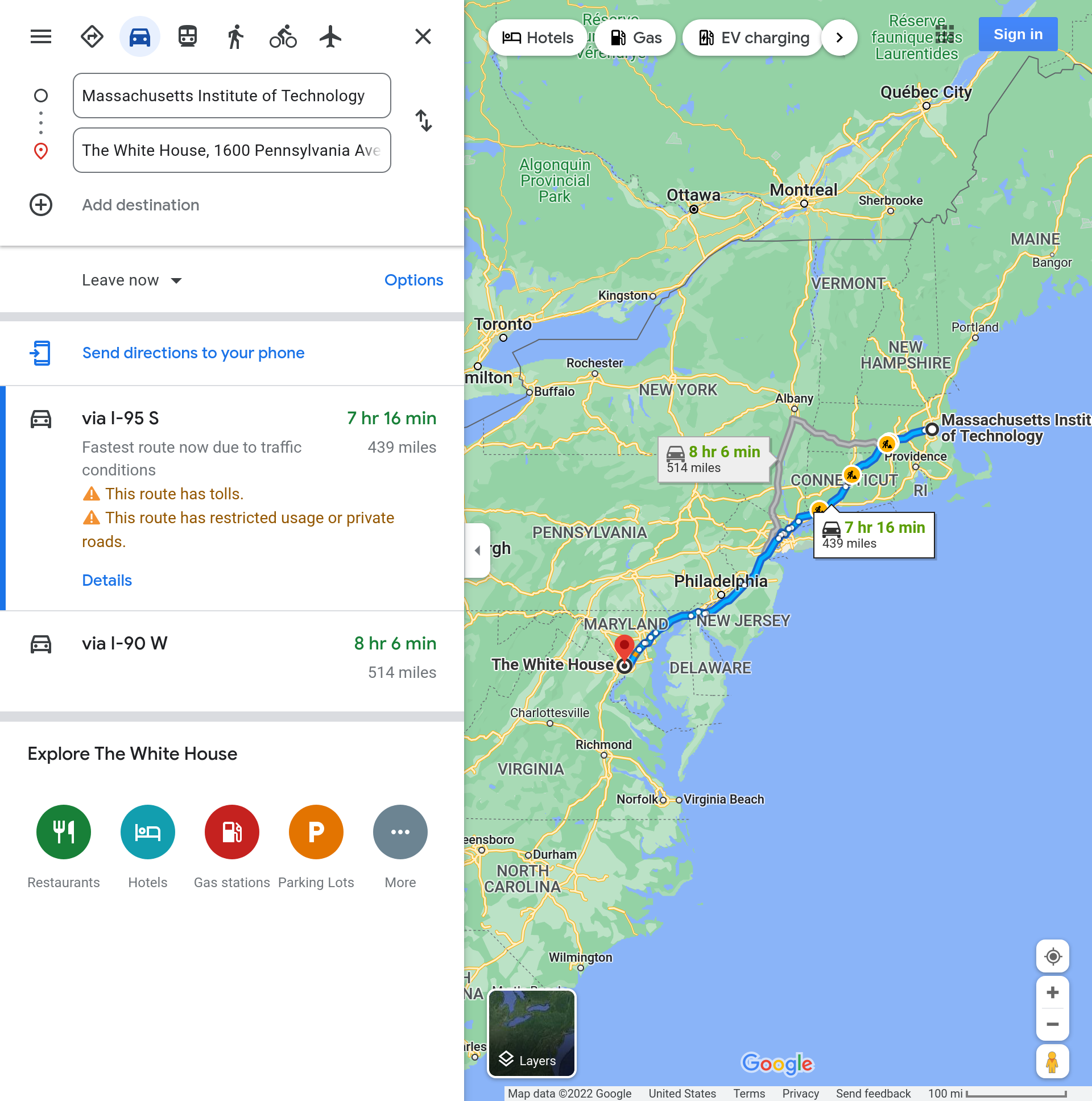

- Do NOT directly upload gas station receipts. Instead, upload a screenshot of Google Maps showing the mileage from the start location to the destination.

Example Google Maps Screenshot

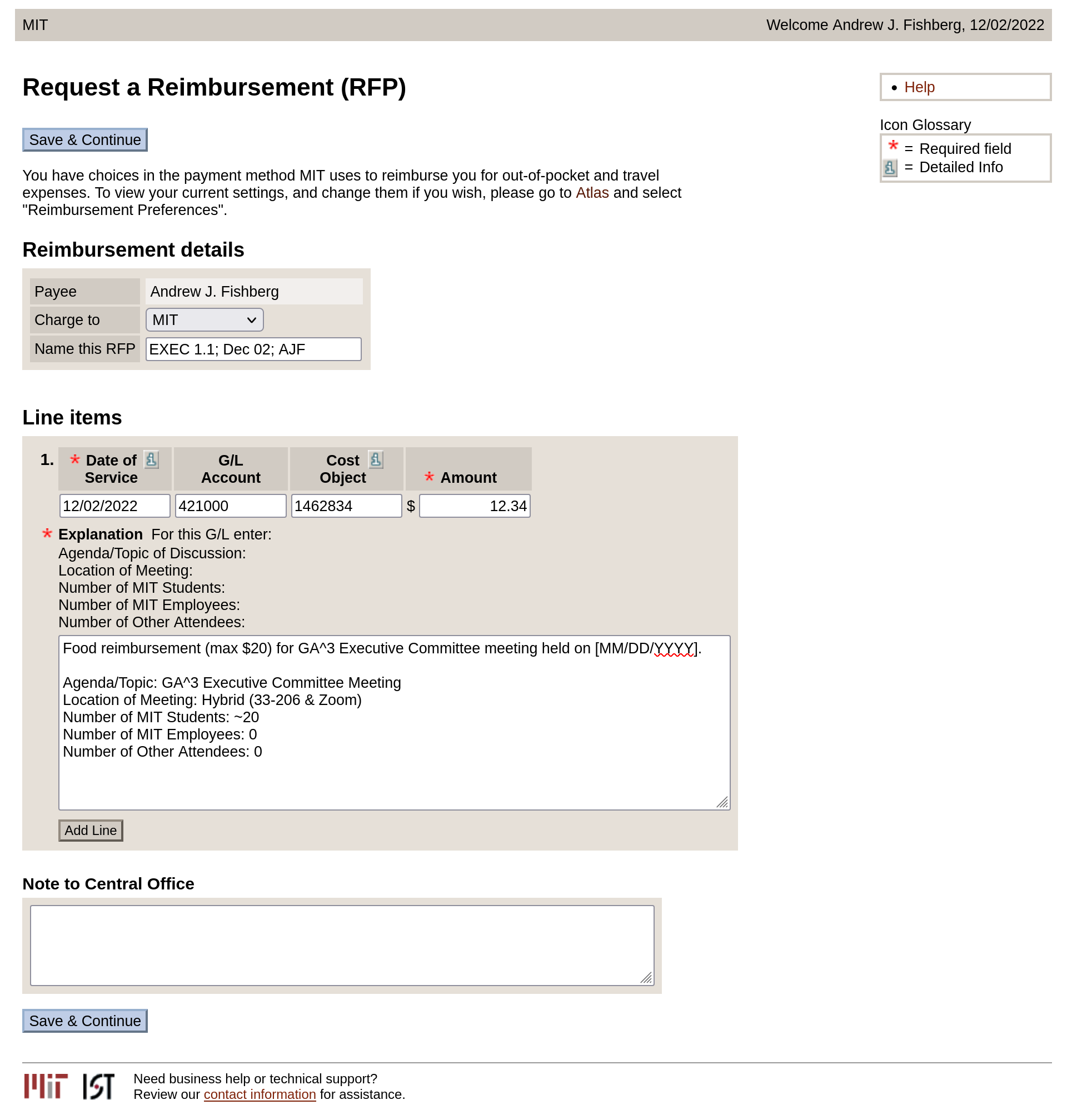

Your completed RFP should look something like this.

Name this RFP

- Template:

[Sub-Budget Code]; [Event Date]; [Your Initials] - Where:

[Sub-Budget Code]is from the current semester’s budget spreadsheet or Funds Viewer[Event Date]is the date of the event in the following formMMM DD(e.g.Jan 31)[Your Initials]are your initials (e.g.AJF)

- Example:

SOC 1.1; Jan 31; AJF

Date of Service

- The

Date of Serviceis the date of the drive in the formMM/DD/YYYY.

G/L Account

420050 - Travel Expenses- For this type of reimbursement, always use this

G/L Accountunless otherwise instructed.

Cost Object

1462834- For this type of reimbursement, always use this

Cost Objectunless otherwise instructed.

Amount

- The total amount to be reimbursed, which is the total number of miles times the current IRS Standard Mileage Rate (see above for current rate). Do NOT include a

$.

Explanation

- Write a few sentences containing all the following material:

[Reimbursement calculation][Drive origin][Drive destination][Total mileage][Number of passengers][Name of event drive was for][Date of drive][Location of event][Approximate number of attendees]

- Example:

Driving 439 miles from MIT (77 Massachusetts Ave, Cambridge, MA 02139, USA) to the White House (1600 Pennsylvania Ave, NW Washington, D.C. 20500).

Car contained 3 additional passengers.

0.70 ($/mi) * 439 (mi) = $307.30

Drive was for the GA^3 DC Tour.

The event was held on 01/31/2022 in Washington DC.

There were approximately 50 attendees.